Great Tax Reference

Check-out this 2 page tax summary. It will answer most of your tax questions for this coming year.

Tax Guide

A daily rant on personal finance and politics while my obligations (family & work) sleep.

Check-out this 2 page tax summary. It will answer most of your tax questions for this coming year.

No Hussman commentary this week... they published their semi-annual report on their funds. Here's a tidbit...

Although the Strategic Growth Fund outperformed the S&P 500 in 2005, it is generally not useful to evaluate Fund returns over such short performance periods, nor over periods restricted to rising-only or falling-only markets. For long-term investors, I believe that an appropriate goal is to achieve strong returns measured over the complete market cycle (bull markets and bear markets combined), while defending capital in market conditions that have typically been unfavorable for stocks. Accordingly, a reasonable way to measure investment performance is to examine periods that include some portion of both bull and bear markets. Evaluating performance between two separate market peaks, including an intervening bear market decline (such as the period from 2000 to the present), provides useful information that is oftenobscured by the use of exact calendar periods.

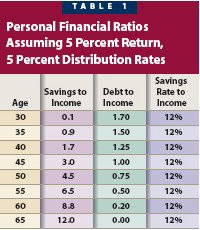

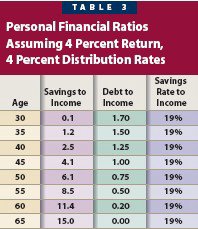

I recently read an interesting article from a professional financial planning journal that used three relatively simple ratios to diagnose your financial health. Here's a link and their executive summary...FPA Journal - Personal Financial Ratios: An Elegant Road Map to Financial Health and Retirement:

"Investors commonly use stock ratios such as the price to earnings, price to book, and dividend yield to assess the financial health of a company because the ratios concisely benchmark a company's financial status.

Clients and their financial advisors have no comparable ratios that would allow investors to conduct a similar analysis of their personal financial circumstances. This article establishes a set of personal financial ratios that individuals can use to analyze their financial standing. Just as stock ratios are primarily based on a company's earnings, the personal financial ratios are based on an individual's income. There are three ratios: savings to income, debt to income, and savings rate to income.

The ratios are derived from a series of assumptions including household budgets, post-retirement income replacement, rates of return, and retirement distribution rates.

The ratios are designed to serve as a road map so that investors can compare their individual ratios against the benchmarks to determine whether they are on track to retire by age 65. The ratios serve as a practical tool for advisors to help convey to their clients the fundamental relationship between one's income, debt, and savings rate, and how those relationships must change over time."

I have a small beef with the author's separation of assets and debt into to separate ratios. I would suggest that you could combine them into: INW/I - investable net worth to income. Simply subtract your D/I from your S/I. My INW/I is 2.2 which would translate to a financial age of 42 or 43.

It looks like I'm on track to hit my magic number (i.e. have enough money to live Harry Newton's life of managing my investments full-time) before I reach 65. I like the simple-to-track goal of accumulating 15 times your salary. I was just commenting to my wife that we're doing well financially but that we really don't have any concrete goals.

I'll continue to watch my ratios and I encourage you to calculate yours and share them with my readers.

Found this great post about religion and morality. It doesn't contain any Earth-shattering revelations and it's a bit harsh on believers. That being said, it's quite funny and clever. Here's an excerpt:

Hussman Funds - Weekly Market Comment: February 21, 2006 - Very Nicely Swept!:

"The same is true of investing. To the casual observer, investing seems to be about finding the next Microsoft or Google (assuming that Google doesn't suddenly find itself looking like the tech-wrecks of several years ago, which I suspect is a poor assumption). The apparent skill seems to be finding the next great growth story, getting an inside line on future earnings prospects, or timing the next market move.

In truth, to my knowledge, skills like that are both unreliable and unnecessary for investment success. They require success to be far, far too specific. Instead, effective long-term investing requires the 'averages' to work out well - not only the average performance of the stocks in a diversified portfolio, but also the average performance of the portfolio over a series of investment horizons.

The key skill required for good investing, in my view, is the willingness to abandon the specific in favor of the average. That means abandoning the attempt to find one or two 'special' and unique stocks, and instead applying a careful stock-selection discipline in order to create a whole portfolio with certain 'average' characteristics of valuation, market action, financial strength, and so forth. It also means abandoning the attempt to forecast the market's direction over some specific period ahead, and instead aligning the investment position with the 'average' return/risk profile that stocks have experienced when historical market conditions have matched prevailing ones.

So winning depends on a specific skill that might not be immediately obvious. That skill is the willingness to focus on average outcomes, and to ignore specific ones. It's a quality that's commonly called 'patience', and it's rewarding precisely because it is rare."

Well kids... I've been blogging for about 2 1/2 months and I recently passed 5,000 visitors and 9,000+ page views. I'm not sure if that's anything to write home about, but I'm going to shamelessly use this occasion to highlights some of my better posts. Enjoy...

Interesting read on using 'down-side' deviation versus the standard deviation as a truer measure of investment risk.

Modern portfolio theory (MPT) and its mean-variance optimization (MVO) model for asset allocation are Nobel Prize-winning theories of global equilibrium, but are unreliable for the primary task to which the financial services industry applies them - building portfolios.

Post-modern portfolio theory (PMPT) presents a new method of asset allocation that optimizes a portfolio based on returns versus downside risk (downside risk optimization, or DRO) instead of MVO.

The core innovation of PMPT is its recognition that standard deviation is a poor proxy for how humans experience risk. Risk is an emotional condition - fear of a bad outcome such as fear of loss, fear of underperformance, or fear of failing to achieve a financial goal. Risk is thus more complex than simple variance but can nonetheless be modeled and described mathematically.

Downside risk (DR) is a definition of risk derived from three sub-measures: downside frequency, mean downside deviation, and downside magnitude. Each of these measures is defined with reference to an investor-specific minimal acceptable return (MAR).

Portfolios created using MVO and DRO are often similar and the differences in absolute risk and return values small-diversification works regardless of how you measure it. Yet DRO seems to avoid the known errors of MVO and provide a more reliable tool for choosing the 'best' portfolio.

PMPT points the way to an improved science of investing that incorporates not only DRO but also behavioral finance and any other innovation that leads to better outcomes."

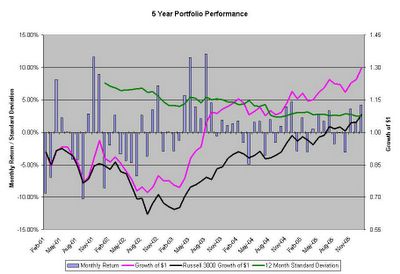

I got some pretty compelling information from Quicken last night. I looked at my portfolio's performance for the past 5 years and how it compares to the Russell 3000 (I had to pull the Russell information from here). The key statistics:

Looks pretty good to me. I beat the market return by 130% (Russell 3000 being a pretty good benchmark) and with only a 10% increase in risk. A few other ratios can tell us if I'm ready to quit my job and become a hedge fund manager...

Not too bad, but I think I'll keep my day job. I graphed my monthly return, a 12 month trailing standard deviation, growth of $1 invested and the growth of $1 in the Russell 3000. Click the image to see a readable image.

Hussman Funds - Weekly Market Comment: February 13, 2006 - The Information is in the Divergences:

"Though the general character of market action in recent weeks has not been too bad, the NYSE advance-decline line (a running tally of daily advancing issues on the NYSE minus declining issues) has appeared out-of-place in the context of other measures. To get at what's happening internally, it's instructive to compare the overall NYSE advance-decline line with the advance-decline line of the 30 stocks in the Dow Jones Industrial Average, as well as the largest 30 stocks in the S&P 500 Index...

Notice the divergence that's been developing since last November. For the past several months, we've been seeing fairly persistent distribution in the largest, most highly capitalized stocks in the market, with trades in these large-cap stocks occurring on weak or subdued breadth. Evidently, the enthusiasm of investors for more speculative, smaller capitalization stocks is not reflected in the core issues that comprise the stock market."

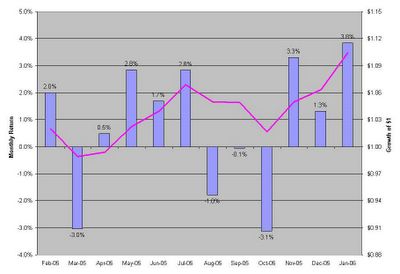

I'm going to start publishing my portfolio's monthly performance. The blue bars represent the portfolio's monthly return and the line is the theoretical growth of $1 from the beginning on the period (click the graph to see a full size image).

I purchased some shares of DryShips (DRYS) this past week. DRYS is a dry bulk ocean shipping line operated out of Greece. This is another Prudent Speculator pick that I found quite compelling...

As always, I didn't take a large position - it's less than 1% of my portfolio. Although it's not in keeping with my new found devotion to index investing, I think it's a good investment and I'm OK with a bit more risk.

As I mentioned before, I'm finally getting serious about my overall asset allocation. I've made a bunch of balancing trades over the last week and I want to start regularly reporting my portfolio's allocation and its performance. I'll show the asset class, my current allocation, my target allocation and Index Investor's allocation:

| Asset Class | Current | ER Policy | II Policy |

|---|---|---|---|

| Cash | 2.4% | 2.5% | 0% |

| Commodities | 9.4% | 10% | 12.5% |

| Domestic Equity | 46.2% | 50% | 52.5% |

| Domestic Real Estate | 4.9% | 5% | 0% |

| Emerging Equity | 11.9% | 10% | 10% |

| Equity Market Neutral | 9.9% | 5% | 5% |

| Foreign Equity | 5.8% | 5% | 5% |

| Foreign Real Estate | 7.4% | 7.5% | 7.5% |

| Timber | 2.1% | 5% | 7.5% |

Don Luskin at The Conspiracy to Keep You Poor and Stupid supplies us an excerpt from John Tierney's latest NYT column:

When something finally comes along that's cheaper and more reliable than oil, no national energy plan will be necessary. Capitalists will be ready to sell it to eager American drivers. For now, the best strategy is to buy gasoline and stop worrying that it's sinful or dangerous.

After you fill up your tank, twist the rear-view mirror so you can gaze at yourself. Repeat these words: 'I'm good enough, I'm rich enough, and doggone it, people in the Middle East like my money.'

When I tell people that I'm a Republican and that I'm active in a UU church, I generally hear 2 questions:

Today, I want to answer the first question. Here we go:

Economics - Even when I was a Democrat (birth to age 30), I generally agreed with free-trade capitalist Republicans versus protectionist-leaning, socialist-coddling Democrats. As nice as it sounds that we should divert the wages of the rich to bring the poor up to middle-class standards of living, it doesn't work. When the government gets too entangled with commerce (whether though excessive taxation, regulation or state-owned enterprises), history has shown that those governments have to start controlling other aspects of citizens' lives in order to get the economic outcomes they desire. Corporations, along with organized religions, also prove to be useful counter-balances against too much government power.

Republicans certainly don't always side with free-market capitalism (I was strongly opposed to the steel tariffs that W pushed though in his first term), but they are head and shoulders above the socialist legislation that the union-dues addicted Democrats would pass if they had control of the government.

Race Relations - Yes, that's right, I believe the Republican party is taking a better approach to race relations than the Democrats. In the past, I believe liberals (I cannot say Democrats due to the despicable behavior of Southern Democrats during the civil rights struggles of the 50's and 60's) had the higher moral ground on matters of race. Additionally, I would credit these social liberals with the dramatic transformation of our society in the last 50 years. That being said, I believe a new approach is needed now that truly racist behavior (i.e. conscious decisions to denigrate someone based on their race) is largely isolated to small pockets of stupidity.

Today, Republicans preach, and largely practice, the idea of meritocracy (i.e. Dr. King's idea that people should be judged by the content of their character) versus the Democrats tendency to confuse unequal outcomes (a fact of life in a free society) with unequal opportunity (racism). Additionally, African-American Democratic leaders have acted so hurtfully and negatively toward fellow African Americans that have chosen to be active Republicans. Claiming that Rice and Powell are 'house slaves' (Belafonte) and throwing oreos at Ohio Republican Michael Steele are indicative of the fear that African Americans may not be a solid Democratic voting block and, god forbid, some may even find an ideological home in the Republican party. Even in the blogging world, Republicans who happen to be minorities, get chastised by left leaning bloggers as being stooges who have been tricked by evil Republicans into selling-out their race (eg. attacks against Michelle Mallkin).

Is Trent Lott an idiot? Yes. Are Republicans hatching a secret plot to keep minorities in the under-classes? Absolutely not. I would argue that the welfare state (which financially supports a culture of teen mothers with disinterested fathers) is the single biggest inhibitor to minority success in America.

National Defense - I remember commenting to one of my most conservative friends on September 12th, 2001 that, although I voted for Gore, I was glad Republicans were running the government. I hadn't always felt this way. I remember thinking in my youth that Reagan's constant jousting with the Soviet Union was unwise and that fighting Communism where ever it reared it's head was simply political theater. Now that I have read Sharansky, Hayek, D'Souza, Sowell and many others, I now believe that Regan's fight against the Soviet Union was the only moral path to take if you truly believe the the inherent worth, dignity and liberty of every person.

I wish I didn't have to get searched at airports and I wish overseas telephone conversations were not at risk of being wiretapped. Higher security, however, comes with a price and to believe otherwise is simply naive. I believe most Americans understand that civil liberties are being encroached upon in the name of national security. I also believe that most Americans are OK with the methods and motives currently employed by the Bush administration. The Democrats appear to be tone deaf on this subject. If they continue to criticize Bush for going to extremes to fight terrorism, they will loose even more power in Washington. Is it possible for Bush to go too far? Absolutely. Any efforts to actually shut-down open debate of issues or turn the CIA against political opponents would be completely unacceptable and I think most Republicans would agree. However, criticizing opponent's arguments as silly or misinformed is not inhibiting free speech nor is there any evidence that Bush is targeting political opponents with the CIA.

Those are my big issues. Are there 'Republican Positions' that I disagree with? Yup... prayer in publicly managed schools is a stupid idea (I think school choice is a great idea), Tom Delay is an a**hole (he thinks atheists are un-American) and consenting adults should be able to do whatever they want in private.

If this discussion of the cartoon riots is any indication of the true feelings of the left's approach to violence and terrorism, the GOP is going to hold the White House for quite a while.

How dare Merck create a vaccine to stop a virus that kills 600,000 kids a year in developing nations when everyone knows that they just using groundbreaking discoveries like these to cover-up their crimes against humanity.

Hussman Funds - Weekly Market Comment: February 6, 2006 - Flying Wallendas: "In short, if we accept market risk by closing down our hedges, it's not enough for the market to advance from here. Given the strong likelihood for disappointing returns over a more extended period of time, we've got to have reasonable confidence that we'll be able to close out our market risk out at even higher levels before conditions deteriorate. In my view, that's a very tall order. Last week, with the ISM figures below expectations but the prices-paid figures above, the employment figures below expectations but the wage inflation figures above, the productivity figures below expectations but the Fed Funds trajectory (as indicated by futures prices) above, and so on, I took the Strategic Growth Fund back to a 95% hedged stance. We've still got a slight amount of uncovered risk, and could very well trade between a full hedge and a 70-80% hedge depending on the quality and character of market action, but overall, the Fund is defensive at present."

Full Disclosure: In the last 4 presidential elections, I voted for: Clinton, Clinton, Gore, Bush. I'm an atheist who grew up in a Jewish household. I was once a member of the ACLU and People For The American Way.

ER,

You have some very interesting perspectives. Most of your posts are insightful or at least thought provoking. You are a very strong supporter of the GOP. It seems mostly for their pro-business economic policy. As a member of UU community, how do you feel about the "RR" (Religious Right) and their control over the party?

Also, do you have any prediction for what will happen in the 2008 election?

Lastly, have you read, It's My Party Too, By Governor Whitman?

I just finished Thomas Friedman's new book, The World Is Flat

I’ve been talking a great deal about the value of index investing even though most of my portfolio is individual stocks. Well, I’m starting to put my money where my mouth is. I took the advice of Index Investor (with a bit of tweaking) and decided on an Early Riser asset allocation. Here it is:

This portfolio is designed to achieve a 7% Real Return (i.e. 7% above US inflation) with the lowest possible annual return standard deviation. This not not exactly the recommended portfolio but I don't want to liquidate all of my holdings due to the potential tax liability on my current winners. Additionally, I will continue to buy some individual stocks (they'll be part of the Domestic Equity allocation) - not because it makes financial sense (passive investing is the way to go), but because I enjoy it.

I'm about 60% complete with the allocation and I'll continue to get my portfolio allocated as close as possible to the policy targets above by investing my new savings into the under allocated asset classes. I'll try to keep you up to date on my performance and progress.

From the People's Cube Republicanism Caused By Brain Disorder, Mutation ...

In a deformed Republican (capitalist) brain, areas that normally control life-sustaining processes (the Guilt Gland, the Envy Center, or the Everything for Free Lobe, etc.) are miniaturized - while other regions become bloated out of proportions (the Personal Responsibility Lobe, the Self-Interest Cluster, or the overdeveloped and inflexible Spinal Cord that is connected to the Absolute Morality Lobe).

Symptoms of a Republican brain mutation include delusional ideas that democracy is the best known form of government, that capitalism creates wealth, that American culture stems from Judeo-Christian tradition, that people all over the world desire liberty and prosperity, that Third World countries should be self-reliant, that moral

standards are absolute and objective, that the individual supersedes the collective, that parents should teach children values and have a wide choice of schools, and similar incoherent ramblings that mimic the speech of the insane. Everyone knows that the complete opposite is true.