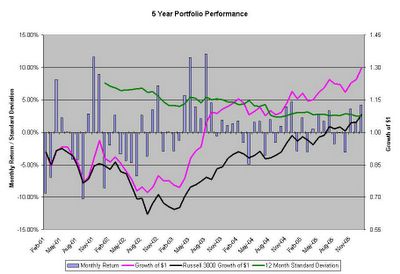

5 year Early Riser Portfolio Performance

I got some pretty compelling information from Quicken last night. I looked at my portfolio's performance for the past 5 years and how it compares to the Russell 3000 (I had to pull the Russell information from here). The key statistics:

- Annualized Return: 5.3% (1.6% for Russell 3k)

- Average Annual Return: 7.3% (3.7%)

- Compounded Monthly Return: 0.434% (0.13%)

- Average Monthly Return: 0.55% (0.22%)

- Monthly Return Standard Deviation: 4.83% (4.37%)

- Correlation to Russell 3000: 0.794

Looks pretty good to me. I beat the market return by 130% (Russell 3000 being a pretty good benchmark) and with only a 10% increase in risk. A few other ratios can tell us if I'm ready to quit my job and become a hedge fund manager...

- Information Ratio: 0.108

- t-Statistic (60 periods): 0.839

Not too bad, but I think I'll keep my day job. I graphed my monthly return, a 12 month trailing standard deviation, growth of $1 invested and the growth of $1 in the Russell 3000. Click the image to see a readable image.

0 Comments:

Post a Comment

<< Home