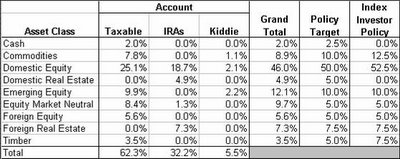

ER Portfolio Allocation - February 2006

As promised, here is my current asset allocation...

(click for larger image)

Overall, I'm pretty happy with the allocation and weights. Here are my thoughts on several of the assets:

- Commodities - I'm pretty weighted toward oil due to my investments in HTE, PVX and PSPFX and I'm not aware of any instruments to get non-energy commodities into my portfolio. Even though I'm under my policy weight, I won't be adding more investment dollars to this asset class anytime soon.

- Domestic Equity - I'm light here but since I haven't included my company stock options in this allocation, I'm not going to make any changes.

- Timber - Once again, I'm light but I'm still a bit skittish on putting more money into a single investment like this. I may buy some more on a market dip.

- Emerging Equity - I'm running heavy and I have one particular investment (SDA) that I should sell but it's got a sizable ($4k) short-term capital gain. It also happens to be in one of my kiddie accounts which makes my decision making even more difficult.

- Equity Market Neutral - All of my EMN holdings are in Hussman's Strategic Growth fund (HSFGX). Even thought I'm over weighted, I'm really enamored (usually a bad thing when your talking about an investment) with this fund and I'm going to 'stay put'. I may even adjust my policy allocation to match my holdings.

This allocation is comprised of 26 stocks, 9 ETFs and 6 mutual funds. I'll detail my investments and their respective asset classes in future postings.

1 Comments:

Early riser,

Nice blog. Regarding commodities, have you considered PCRDX/DBC or a diversified miner like BHP?

I also noticed that you don't have any bonds in the portfolio.

ML

InvestMiddleWay.blogspot.com

Post a Comment

<< Home