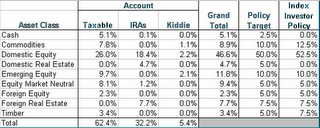

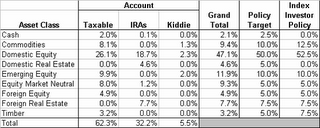

ER Portfolio Allocation - April 2006

Here's my latest asset allocation (click for a larger image)...

Not too different from my March allocation... I did reduce my cash position from 5.1% down to 2.1% by purchasing EFV (Foreign Value Index) and EWU (UK Index). This move also brought by foreign equity position from 2.3% up to 4.9% - close to my policy target.

I am still a bit overweight in Emerging Equity and I'll probably end up selling AUO (an Emerging Equity Prudent Speculator pick) this coming month. I've got a 32% return and I really have no business owning any single emerging equity stock.

I'll be compiling my portfolio performance this weekend and I'm guessing April will be another good month.