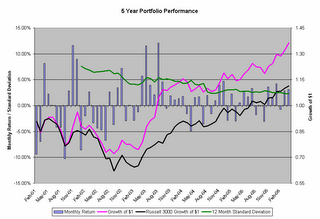

ER Portfolio Performance - April 2006

April was a great month...

- April 2006 Return - 3.11% (versus 1.08% for the Russell 3000)

- Year To Date Return - 9.61% (6.45%)

- Last 12 Months Return - 18.50% (18.09%)

- 12 Month Standard Deviation - 2.3% (2.2%)

- 2/1/2001 through 4/30/06 Cumulative Return - 36% (11%)

- 2/1/2001 through 4/30/06 Annualized Return - 6.1% (2.1%)

My annualized compounded return of 6.1% is OK but my retirement nest egg isn't going to meet my needs on investment growth alone. What, you ask, could be more important than high investment returns? Well, if you're a working stiff like me and you don't have a trust fund, it's all about your propensity to save versus spend.

I looked at my net worth growth over the last 5+ years (the same period of the long term calculations above) and calculated its annualized compounded growth. I excluded any rise is the value of my home because I really didn't have anything to do with that... don't get me wrong... it's great - I just want to look at actual savings.

Here are the numbers:

- Total 63 month increase in net worth: 177%

- Annualized increase: 21.4%

So my investments returned 6.1% annually but my net worth increased 21.4% annually! The 15.3% difference is my ability to save. As my net worth grows, I doubt I'll be able to keep this frenetic savings rate at the 15+% level. It is, however, pretty compelling evidence that savings (at least for me) is dramatically more important that investment return when you are in the first 15 years of our earnings life.

0 Comments:

Post a Comment

<< Home