I ran across an article that mentioned an idea to arbitrage closed-end fund discounts against their ETF counterparts. Huh?

OK... let me break-down what I mean. Arbitrage is an investing behavior where you try to earn extra dollars by exploiting a market inefficiency while, at the same time, not taking-on any more 'market risk'.

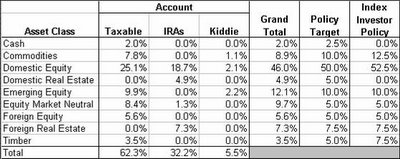

Closed-end funds (CEF) are fixed (unlike ETFs and normal mutual funds that grow and shrink as investors enter and exit the fund) investment pools that trade like stocks. Their market price rarely equals their Net Asset Value (NAV) and, several months after a CEF launch, most trade at a discount to their NAV. One of the neat things about CEFs is that once they launch, their managers can invest without being burdened by money inflows or outflows - they managed a fixed pool of funds.

So the idea is to reduce your ETF or normal mutual fund holdings in an asset class where you can buy a deeply discounted CEF. This way, you keep your market exposure steady while looking to juice your returns by betting that the CEF discount will narrow as the market becomes more efficient.

Right now, Real Estate CEFs are trading at pretty big discounts (14-16%) to NAV. Here's a

screen to see CEF discounts. Do you see

NRI? It's one of the largest real estate CEFs and it's trading at an attractive discount. Remember, if the Board of NRI decided to liquidate or concert the fund to a normal mutual fund (two things that can happen when investors get ancy about big discounts) the fund's price would jump 17.6% (1/(1-discount)). I sold half of my IYR and invested it into NRI... same asset class risk + possible arbitrage earnings.

What are the risks?

- CEF's are often thinly traded so liquidity can be a problem if you want to get in or out of the investment quickly... not an issue for me - I want exposure to this asset class long-term.

- The CEF discount could reflect the illiquidity or poor valuation of the CEF's holdings. CEFs can hold non-traditional investments that may be difficult to sell and/or accurately value.

- The CEF discount could be due to poor management of the fund.

- The CEF discount could widen - for NRI, I'm hard pressed to believe that the discount could get much bigger than it currently is... I guess we'll see.

Note: this is not for the timid or the uninformed. Most importantly - this is not investment advice!